Find Your Dream Property in Spain with OR Nordic Estate

Buying a home in Spain should be exciting, not stressful. At OR NORDIC, we understand the concerns international buyers face-hidden costs, unclear processes, and unreliable agents. That´s why we stand for Open & Reliable service, providing full transparency, expert local knowledge, and guidance at every step.

Your Partner IN Property

We speak your language and ensure smooth communication throughout the process. And our support does not stop at the purchase, we are here for you before, during and long after you receive the keys.

With OR NORDIC, you are not just buying a home; you are gaining a trusted partner in Spain.

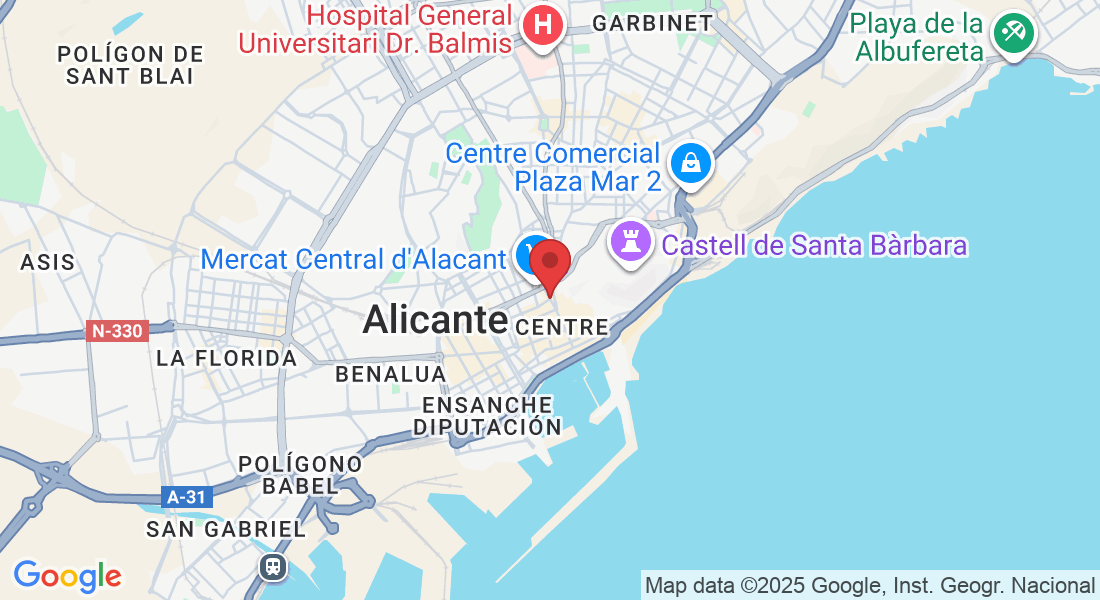

We are based in sunny Alicante, Costa Blanca, and we do love to help you with all your property needs in Spain! Whether you are ready to buy, need advice, or just want to chat about your options, we are here to guide you every step of the way.

Alicante lies in the heart of the Costa Blanca, home to some of Spain’s most sought-after coastal destinations, including

Benidorm, Denia, Torrevieja, Calpe, Jávea, Altea, Villajoyosa, Moraira, and Guardamar.

We offer a wide range of properties along this stunning coastline, ensuring you’ll find the perfect home to match your lifestyle. Whether you’re seeking a holiday retreat, a smart investment, or a new place to call home, we’ll be with you every step of the way, making the process of buying in Spain simple, safe, and stress-free.

OR NORDIC - Services

Your Partner IN Property

Why Choose Costa Blanca

Costa Blanca offers a unique blend of sunshine, beautiful beaches, and a welcoming expat community. With affordable properties and a relaxed lifestyle, it’s the perfect place for both a holiday home or permanent living. Whether you’re seeking tranquility or adventure, Costa Blanca has something for everyone. Ready to make your dream a reality? Contact us today to start your journey!

Buying as a Foreigner in Spain

Spain offers an excellent opportunity for foreign buyers, whether you're looking for a vacation home, investment property, or a permanent move. The process can be complex, but with the right guidance, it’s seamless.

Buying in Spain doesn’t have to be complicated: we guide you every step of the way.

Need a Mortgage in Spain? We’ve Got You Covered!

Financing a property in Spain doesn’t have to be complicated, we make it easy. We collaborate with trusted local banks to secure loans of up to 70% of the property price at competitive interest rates. With our expert guidance, you can navigate the process smoothly and with confidence.

Investing in Spain - Is it right for you?

Costa Blanca is a smart choice for property investment. With rising demand, strong rental yields, and lower prices compared to other Mediterranean hotspots, it’s a market with great potential. Whether you're looking for a profitable rental or long-term value, this region offers a promising future. Want to learn more? Contact us today and let’s talk about your investment options!

Meet the team

Our Excellent & Expert Staff

Curious about who we are and why we do what we do? Meet the team and let’s begin your journey together!

Sergio Ferreira

Real Estate Partner

🇳🇱 🇬🇧 🇩🇪 🇧🇬

Ramin David

Real Estate Partner

🇳🇴 🇸🇪 🇪🇸 🇬🇧 🇮🇷

Jonah v. Beijnen

Real Estate Partner

🇳🇱 🇬🇧 🇩🇪

Marianne Bro

OR Nordic Support Partner

🇳🇴 🇸🇪 🇩🇰 🇪🇸 🇬🇧

FAQ

Can foreigners buy property in Spain?

Yes! Spain welcomes foreign buyers, and the process is straightforward with the right guidance.

Do I need a Spanish bank account?

It’s highly recommended, especially for mortgage payments and utility bills. We can assist in setting one up.

What is an NIE number, and why do I need it?

The NIE (Número de Identificación de Extranjero) is a tax identification number required for all property transactions.

Can I get a mortgage in Spain as a non-resident?

Yes, non-residents can finance up to 70% of the property value. We work with local banks to help secure the best terms.

What additional costs should I expect?

Besides the property price, factor in taxes, legal fees, and notary costs, usually 10-15% of the purchase price.